Cryptocurrency Prices by Coinlib

Shiba Inu eyes 75-days-range breakout: Is 110% gain possible now?

[ad_1]

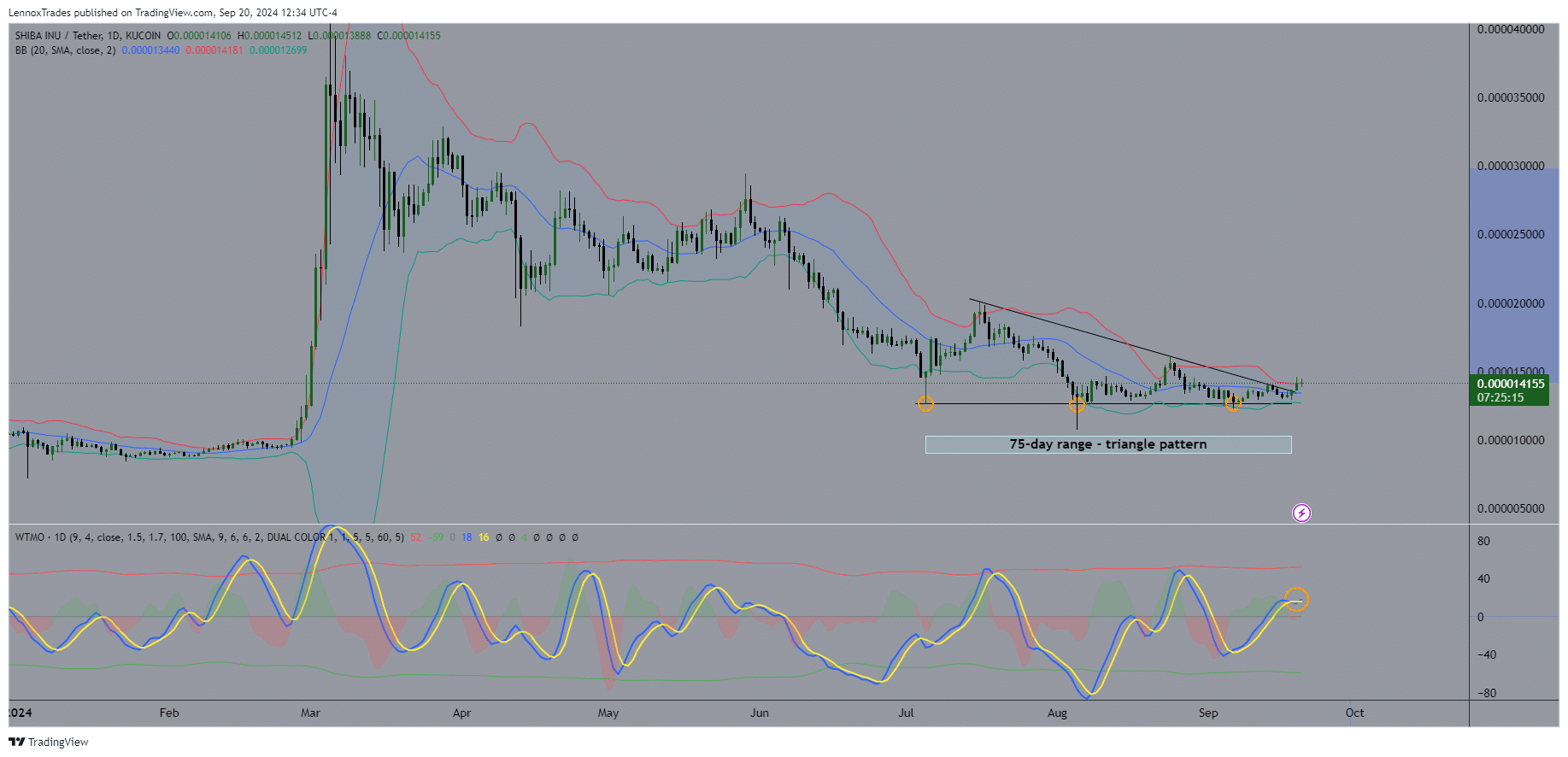

- SHIB shows signs of breakout from a 75-days-range.

- Order book liquidity delta indicates depth of buy orders is thicker than sell orders.

Shiba Inu [SHIB], the second-largest memecoin, has been consolidating near the $0.000014416 support zone for sometime now. It has tested this level three times but hasn’t broken below it.

However, the price action of SHIB/USDT now shows potential for a 75-day-range breakout. At press time, the Bollinger Bands, which had been tightly squeezed, were beginning to widen.

This development could signal the end of consolidation. Additionally, the wave trend momentum oscillator has made a golden cross, further indicating increased buying pressure and market momentum.

With the overall crypto market showing signs of strength, as seen in Bitcoin and most altcoins, SHIB presents an opportunity to go long.

If Shiba Inu breaks from its consolidation and confirms with a retest, it could see returns of up to 110%, if it reaches the $0.00002949 level by next year. A 300% gain is also a possibility as previous AMBCrypto analysis indicated.

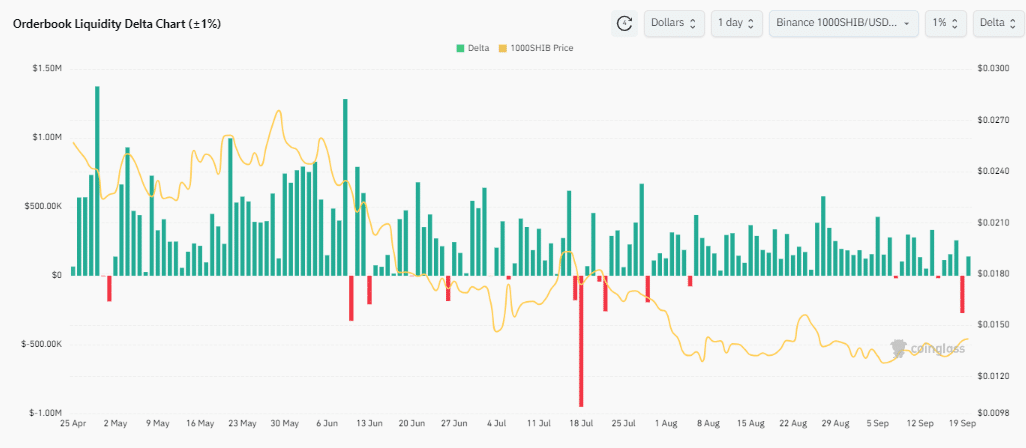

Orderbook Liquidity Delta signals…

The aggregate order book depth difference, which measures liquidity in buy and sell orders, indicates that buy orders currently outweigh sell orders.

Since 25th April, most days have shown stronger buy-side liquidity, with only 15 days of sell-side dominance.

This trend suggests traders have been accumulating despite its range-bound, down-trending movement. This accumulation of long positions adds more confluence to the idea that SHIB is nearing a breakout from the Bollinger Band squeeze.

While order book liquidity does not determine price by itself, the large number of buy orders could act as a catalyst, driving SHIB’s price higher.

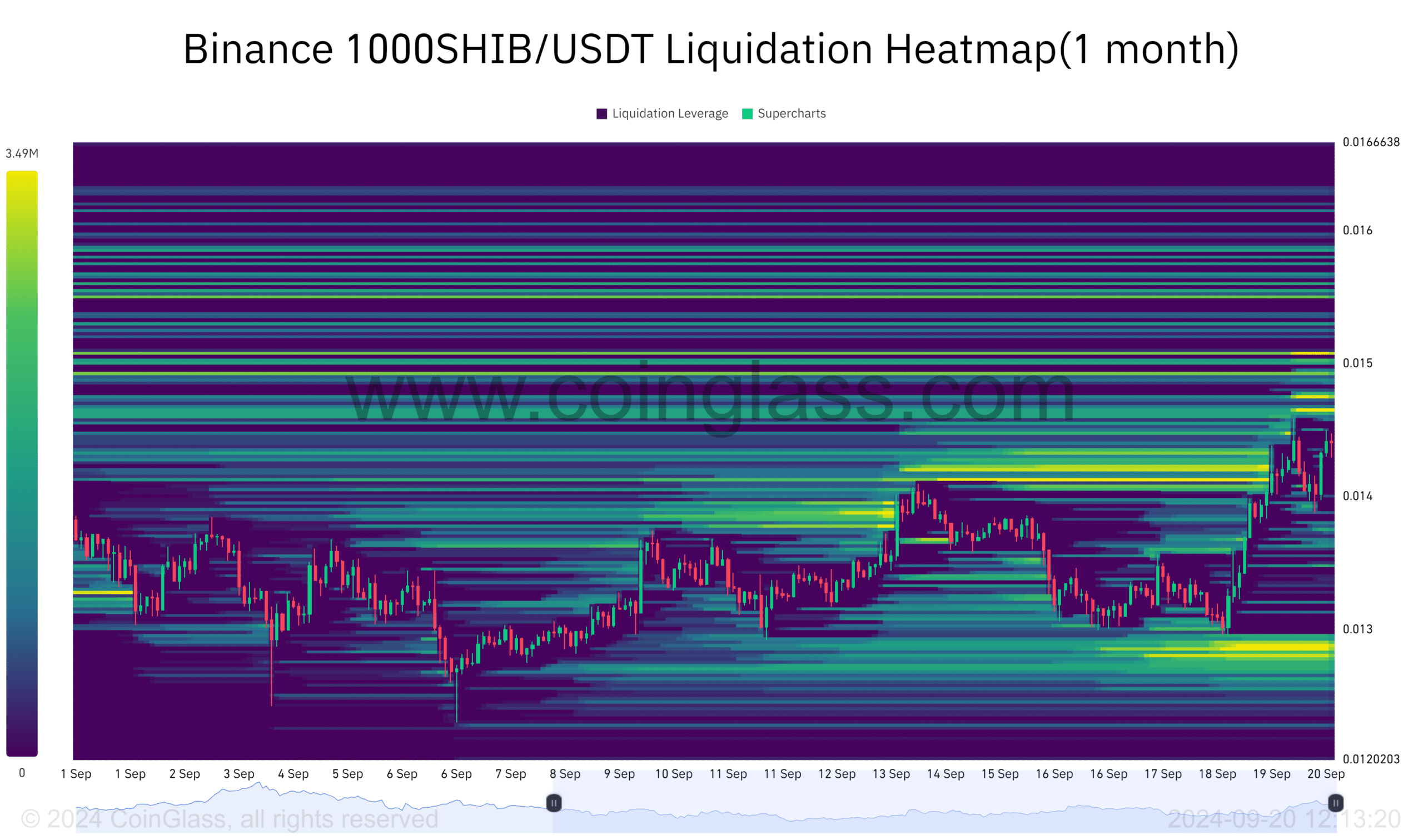

SHIB liquidation heatmap

The market tends to gravitate toward high liquidation clusters, so SHIB’s current price action likely targets the $0.0000146 level, where $3.49M worth of SHIB shorts will be liquidated.

Further price advances could trigger additional liquidations, including $2.91M at the $0.0000147 zone.

As these zones are close, even a brief price spike could pick up this liquidity. Once this liquidity is tapped, SHIB could push further to the $0.000015 level, where $3.13M is primed for liquidation.

These clusters act as magnets, and once cleared, they could fuel SHIB’s price to move higher, targeting the liquidity that rests just below the current price at $0.0000128, where $3.2M worth of SHIB is set for liquidation.

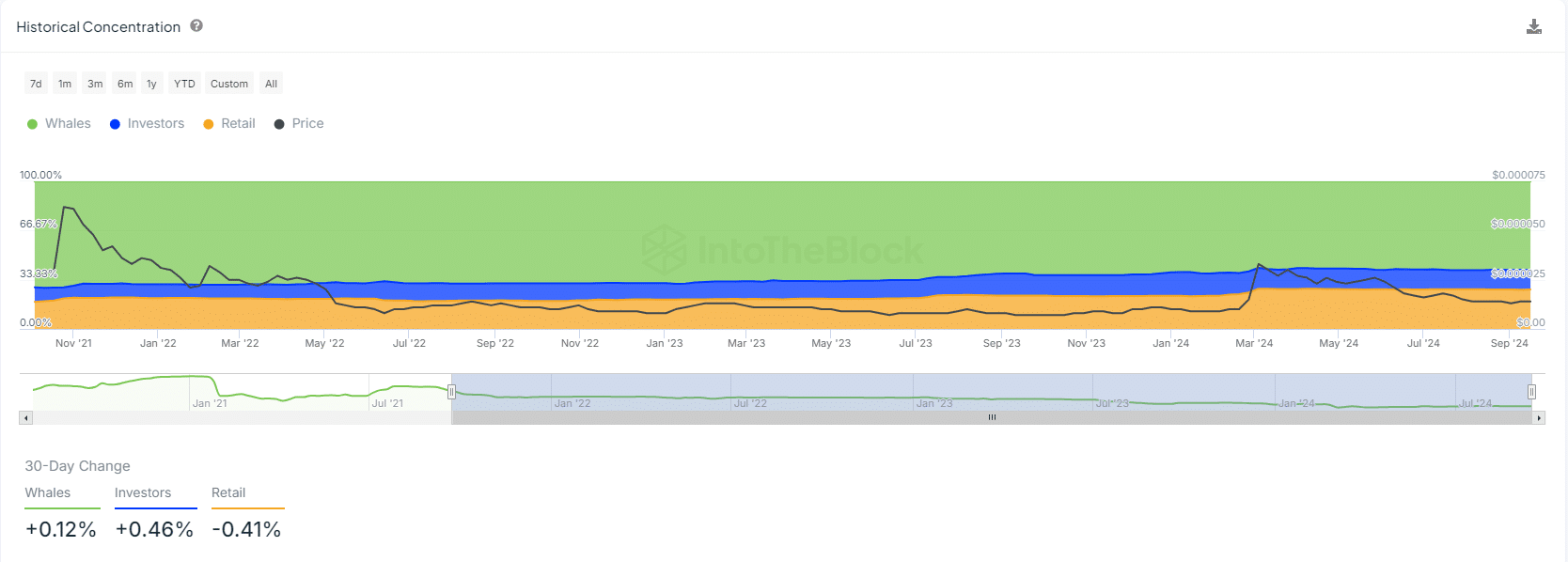

Ownership by concentration

Historically, whales have dominated SHIB ownership, holding 59.97% of the total supply, or 589.99t SHIB. Investors own 26.74%, while retail traders hold 13.29%, which equals 130.78t SHIB.

Is your portfolio green? Check out the SHIB Profit Calculator

Whale holdings have increased by 0.12%, and large investors’ stakes have grown by 0.46%. Meanwhile, retail ownership has declined by 0.41% but not an issue of much concern.

The growing accumulation by whales and larger investors suggests that a breakout and surge in SHIB’s price may be imminent.

[ad_2]